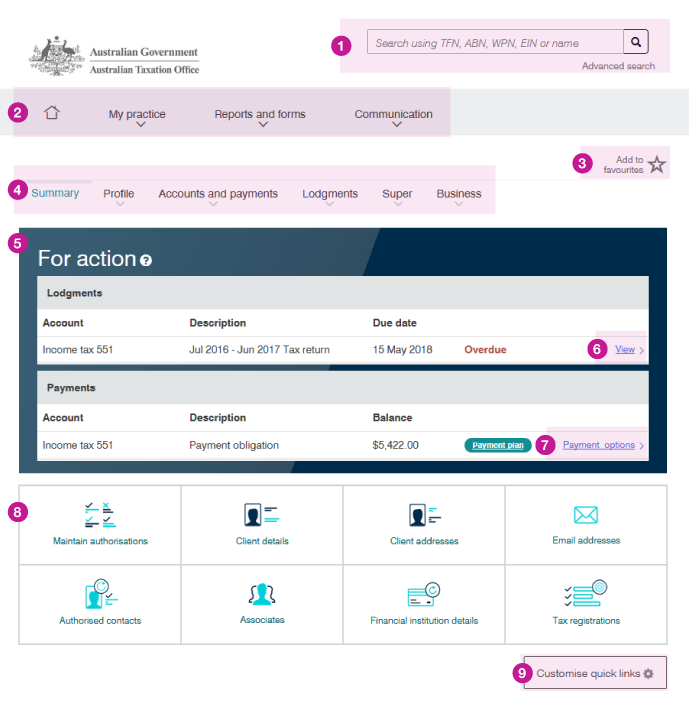

Australian Taxation Office - Do you lodge your BAS online via myGov? We'll send you email or SMS notifications to let you know when there are new messages in your myGov Inbox.

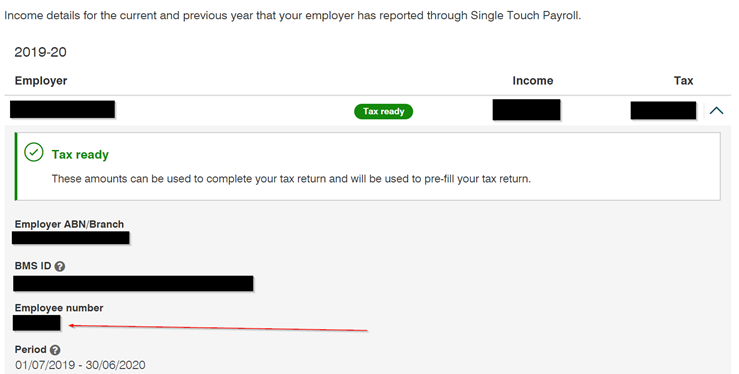

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

Solved: I get this when I try to lodge me BAS - We can't e-lodge this activity statement, as the software Id i

Australian Taxation Office - BAS tip: Check twice to make sure you only have to lodge once! Avoid common BAS errors by checking all invoices are correct, claiming for the current tax