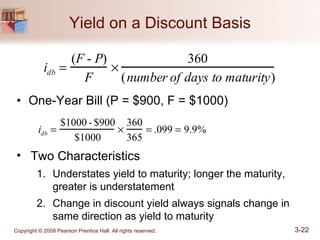

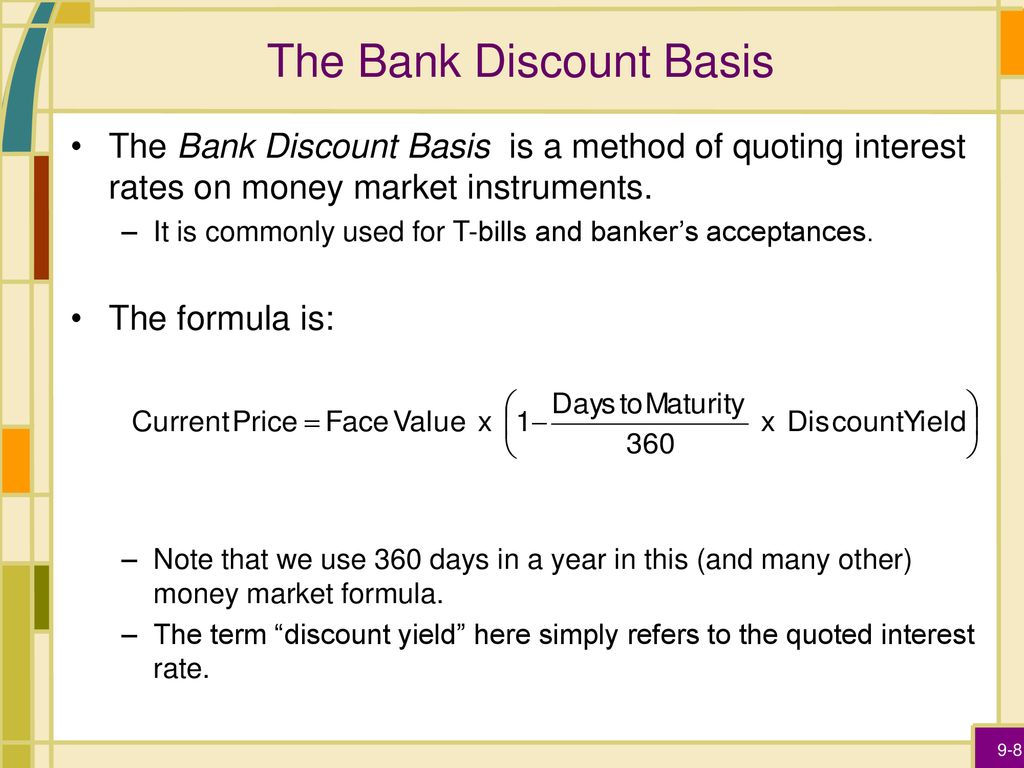

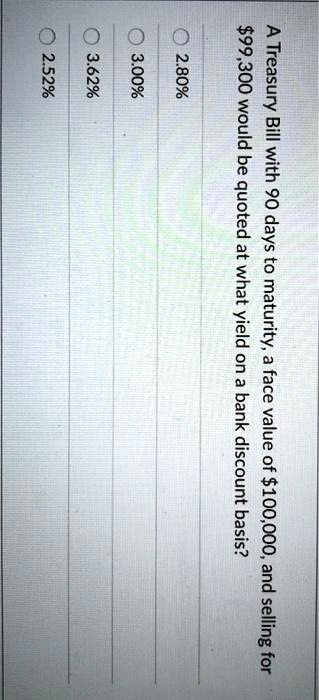

SOLVED: O2.52% O.3.62% %000 O2.80% $99,300 would be quoted at what yield on a bank discount basis? A Treasury Bill with 90 days to maturity,a face value of$100,000, and selling for

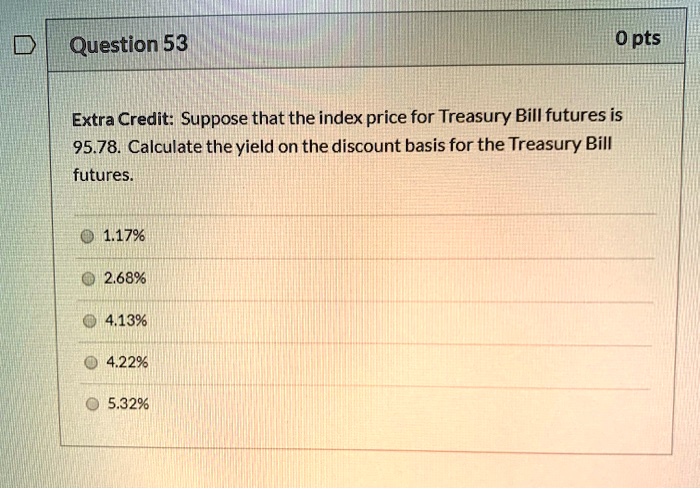

SOLVED: Question53 0 pts Extra Credit:Suppose that the index price for Treasury Bill futures is 95.78.Calculate the yield on the discount basis for the Treasury Bill futures. 1.17% 2.68% 4.13% 4.22% 5.32%

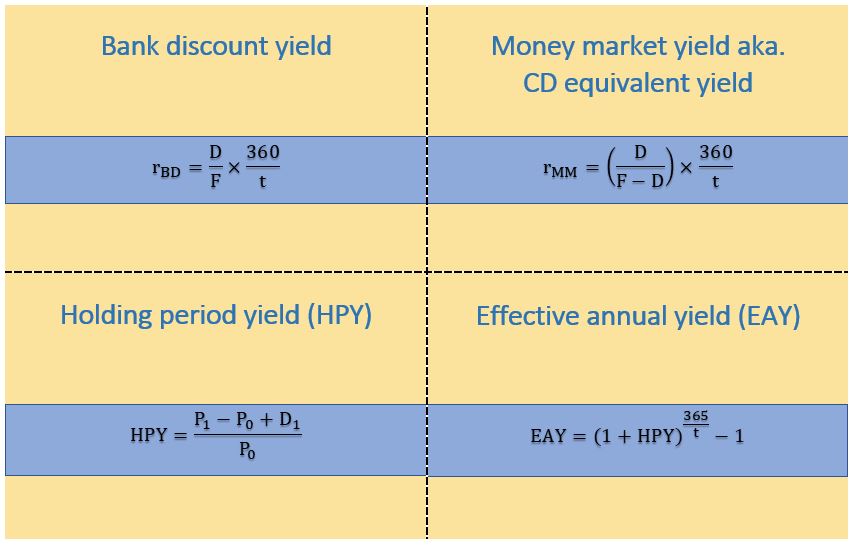

LOS 7.E Calculate and Interp Bank Discount Yield, Holding Period Yield, Effective Annual Yield, and Money Mkt Yield for US Treasury bills and other money market instruments Flashcards | Quizlet