Addressing Tax BEPS in the Mining Industry in Developing Countries | Brochure (EN/FR/ES) - IGF Mining

Action Plan On Base Erosion And Profit Shifting: Organization for Economic Cooperation and Development: 9789264202702: Amazon.com: Books

OECD/G20 Base Erosion and Profit Shifting Project Limiting Base Erosion Involving Interest Deduction by

Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting – New Reality

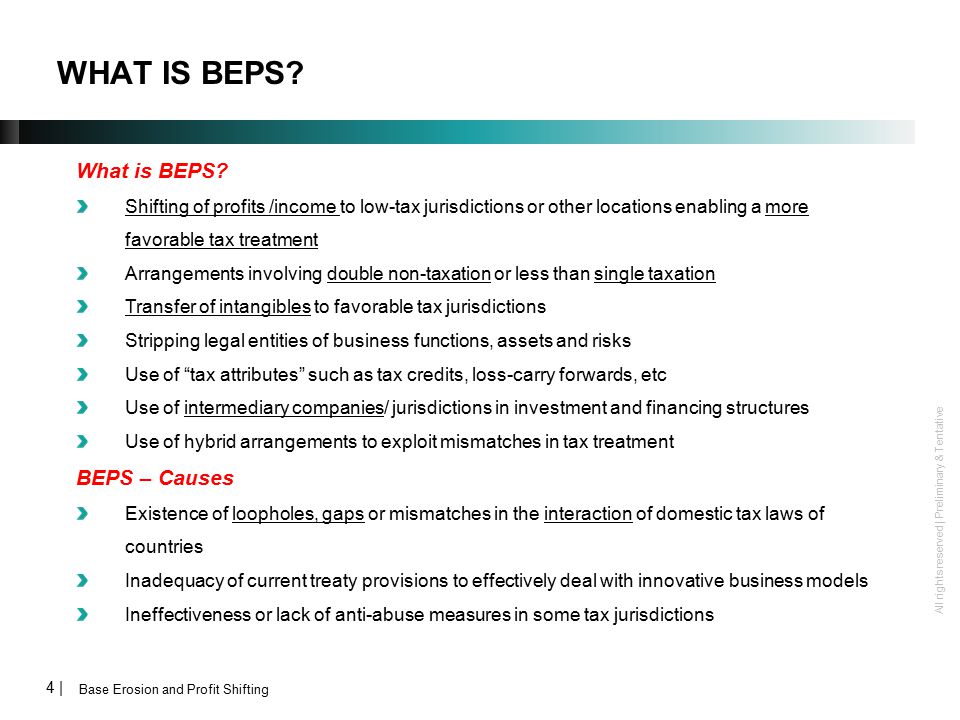

What are Illicit Financial Flows and Base Erosion and Profit Shifting - AIDC | Alternative Information & Development Centre

OECD Tax on Twitter: "📣 @OECD secretariat invites public input on the Global Anti-Base Erosion (#GloBE) Proposal under Pillar 2 ➡️ https://t.co/npcIDA6EEA ⏳ Deadline for comments: 2 December 🗓️ Public consultation meeting: